Insights | Intra-African Payments and Collaboration at Scale

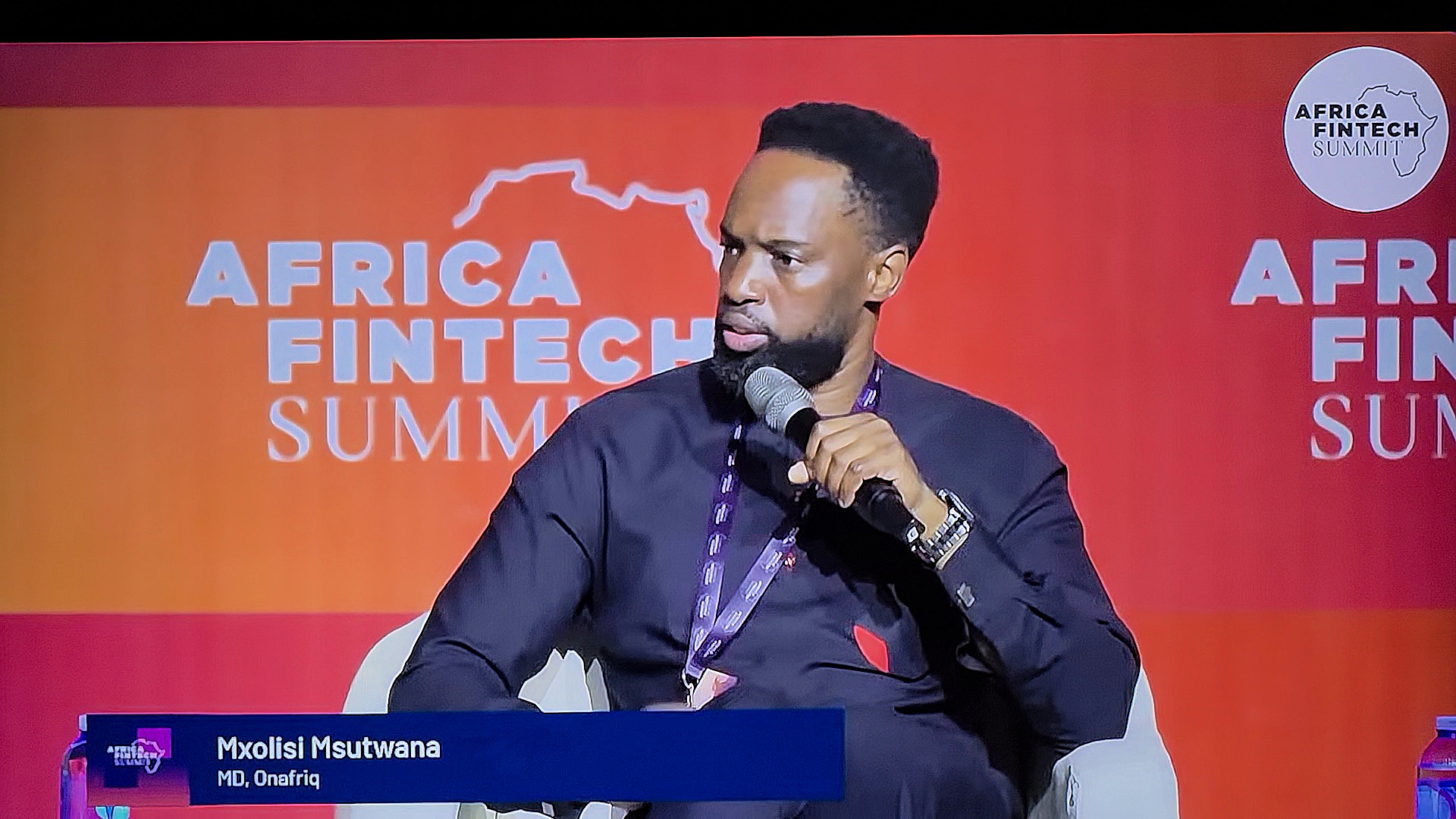

Following his fireside chat at the Africa Fintech Summit in Accra, Mxolisi Msutwana, Managing Director for Anglophone West Africa at Onafriq, reflects on how collaboration between AfCFTA, PAPSS, and Onafriq is shaping the future of intra-Africa payments and trade connectivity.

The AfCFTA (African Continental Free Trade Area), PAPSS (Pan-African Payments and Settlement System), and Onafriq alignment, which aim to make intra-African trade not only a reality but also quick and easy, rest on the timing and convergence of separate but complementary visions.

This grand vision required each of these three separate visions to solidify and be tested independently before intersecting to begin to create what would have been considered a mere concept 15 years ago.

The complexity and key achievements of each respective vision rest on:

- AfCFTA's success in securing the commitment of 54 African countries to free trade principles (the aim ultimately being to reduce intra-African tariffs by upwards of 90%), and its ongoing work to develop unified protocols through complex tariff-breaking frameworks.

- PAPSS, having signed agreements with 18 central banks and over 150 banks to harmonise cross-border trade settlements and work towards reducing transaction completion times from five/seven days to less than two minutes.

- Onafriq’s singular focus on removing cross-border payments challenges and creating true interoperability, along with key work that has resulted in the ecosystem consisting of 1 billion connected mobile money wallets and 500 million bank accounts across 43 countries, while actively working to address messaging, compliance & regulatory, and settlement layers.

The scale of achievement is significant.

Our joint pilot program in Ghana, in collaboration with the Bank of Ghana (BoG) and PAPSS, enables mobile money wallet-to-bank and wallet payments to Nigeria. This is a crucial first step in establishing a cross-border intra-Africa trade payment rail that integrates banking infrastructure with the mobile money ecosystem.

In the context of intra-African trade, it is essential to create seamless rails between these two worlds. This is driven by collaboration, not competition, to pave the way for African businesses to trade with each other effectively.

On a broader scale, much of the work has been towards addressing challenges around:

- Traffic harmonisation across the continent.

- A common approach to managing trade constraints such as costs.

- Clarity on the future role of the USD.

- Thinking around regulations that support bi-directional trade corridors between countries.

- Creation and operation of trade payments infrastructure involving multi-country public-private partnerships.

In our next step, we must continue to think and work to also address key operational and regulatory concerns, including:

- The understandable concern around capital flight, which can hinder the scaling of bi-directional intra-Africa corridors. Commitment to bi-directional corridor opening and operation principle is central to our success in this area.

- Concerns about the impact on currency – the aim is to decouple from this impact, reduce this worry, and promote local currency trading between countries.

- The cost structures - informal systems which, despite their inefficiencies, have achieved a certain level of cost efficiency within their limitations. We need to leverage the efficiency of new rails to reduce trading costs (in addition to the convenience and speed) and create compelling, enabling rails for SMEs.

In closing, we must align our regulatory, settlement, and cost-management strategies across countries and intra-African trading zones.

This is collaboration at scale.