Domestic and cross-border bulk payouts

Disburse salaries, loans or grants directly to mobile money wallets, offline agents for cash pick-ups or bank accounts in one country or across multiple markets. Secure your recipients’ trust with excellent transfer speed and zero delays.

Plug and Play

Disburse your funds through our user-friendly portal or via our simple API option.

Pan African Reach

Make bulk payments to mobile wallets across multiple countries with real-time reconciliation and identity verification for mobile money accounts.

Real-time data and analytics

We provide you with a 360 view of all your transactions anytime, anywhere. You also have access to real-time data and analytics with a customisable dashboard.

One Integration = Many Partners

Reduce time and resources spent on multiple direct integrations and partnerships. Through Onafriq’s one-step integration, you instantly have access to our network of payment partners and major mobile money schemes across countries and markets.

Transparency

Our efficient financial management tools and record-keeping database help simplify your payment processes and give more transparency over your finances.

Global and intra-Africa Remittances

Onafriq adds value to your offering by connecting you directly to 1 billion wallets, enabling your customers to make fast and secure peer-to-peer transactions domestically, across networks and borders.

Two-party model

We provide direct connections to major mobile money schemes with a single contract. With our real-time bi-directional payment capabilities, you can activate multiple corridors and use cases.

Single settlement partner

We remove the complexity of settling with partners in multiple currencies and provide settlement to you in one currency.

Network

Direct connections with MNOs provide you with mobile number validation and real-time payment capabilities designed for local conditions.

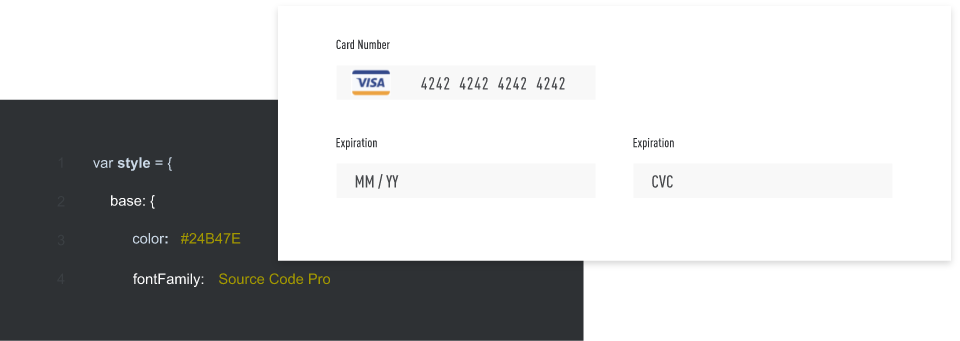

Simple API

Integrate easily with our simple API via a virtual private cloud.

Support

We provide 24 hours technical support with an option of self-service. Our regional teams with African payments expertise are spread across multiple countries.

Reports

We ensure accurate and timely reports for all your transactions with also an option of self-service.

Compliance

Our ongoing compliance monitoring ensures we always adhere to local and global compliance standards.

Safe and Secure Transactions

Onafriq actively takes measures to guard against money laundering, terrorism financing, and any other criminal activities by ensuring compliance with laws and regulations.

In addition to the ISO 27001 and CMML3 certification, we employ cutting edge security technology to protect our partners and transactions.

Detect

On-going transaction monitoring to detect and deter fraudulent and suspicious activity.

Resist

Best in class tech processes and security systems to ensure the safety of customers and transactions.

React

We take a proactive approach toward security.

Our compliance culture

Disbursing funds across multiple markets requires navigating each country’s regulatory and licensing system.

- Onafriq will work with you to determine the best API for your specific needs.

- We adhere to and continuously monitor global and local compliance standards.

- We are licensed in Mauritius, Ghana, Nigeria, the Democratic Republic of the Congo, Uganda, Tanzania, Rwanda, and the United Kingdom.

What next?

We go live with the following steps:

01

02

03