Online Collections

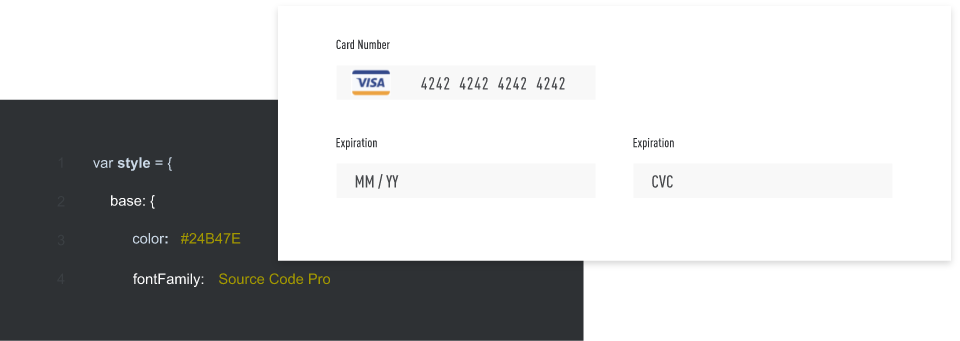

Our API and self-service portal support merchant-pull and subscriber-initiated collections and integrate seamlessly with various third-party platforms.

Through our two-party model, we provide you with a single business information tool and remove the complexity of dealing with multiple mobile networks and multiple balances.

Convenience of Collections

Benefit from our expansive footprint and enable collections across multiple MNOs.

Technology for Local Conditions

Access to proven technology designed for local conditions is supported by regional teams with expertise in African payments.

Collections Settlement

Enable collections across multiple countries and receive settlement funds in US dollars directly to your main bank account.

Real time confirmation

On all transactions, we provide you with real-time confirmation on the status of your collections.

Scale Faster

Onafriq can help you scale faster and more cost-effectively by giving you access to more mobile money consumers, bank accounts and markets.

Cash Collections

Receive cash payments for a wide range of services through our agent network in Nigeria.

With over 300,000 agents, our offline payments service covers all 36 states in the country, providing you with a seamless flow of transactions.

Reduced Downtime

Transaction downtime is significantly reduced, resulting in increased sales.

Simple Platform

Our platform is easy and convenient to use, with access to your transaction history, customer data and more.

Cash Reconciliation Management

Access to an embedded accounting and reporting system to facilitate efficient cash reconciliation and management.

Fast Transaction Processing

Transactions are speedy, which reduces wait time and maximises convenience for your customers.

Safe and Secure Transactions

Onafriq actively takes measures to guard against money laundering, terrorism financing, and any other criminal activities by ensuring compliance with laws and regulations.

In addition to the ISO 27001 and CMML3 certification, we employ cutting edge security technology to protect our partners and transactions.

Detect

On-going transaction monitoring to detect and deter fraudulent and suspicious activity.

Resist

Best in class tech processes and security systems to ensure the safety of customers and transactions.

React

We take a proactive approach toward security.

Our compliance culture

Collecting funds across multiple markets requires navigating each country’s regulatory and licensing system.

- Onafriq will work with you to determine the best API for your specific needs.

- We adhere to and continuously monitor global and local compliance standards.

- We are licensed in Mauritius, Ghana, Nigeria, the Democratic Republic of the Congo, Uganda, Tanzania, Rwanda, and the United Kingdom.

What next?

We go live with the following steps:

01

02

03